The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) repealed the sustainable growth rate (SGR) system and established a new approach to updating payments to clinicians. It established two paths—a path for clinicians who participate in eligible alternative payment models (eligible APMs); and a path for other clinicians, who are subject to the Merit-Based Incentive Payment System (MIPS).

In order to implement MACRA, CMS will need to conduct rulemaking over the next two years to establish specific definitions for the APM and MIPS payment paths. At its October meeting, the Commission began an initial discussion about what guidance it might provide to CMS throughout the rulemaking process. To provide a firm foundation for this discussion, the Commission first reviewed the relevant provisions of MACRA. This post provides a guide to some of the key requirements of the law.

How does a clinician end up in one path or the other?

Starting in 2019, clinicians will be classified into one of two payment paths—the APM path or the MIPS path. To participate in the APM path, clinicians must have a minimum share of their Medicare fee-for-service (FFS) revenue (or FFS patients) coming through an “eligible” APM. The minimum APM share increases over time, from 25% in 2018 to 75% in 2022. Though the APM share calculation initially includes only FFS revenue and patients, there is an option for CMS to begin using an all-payer calculation in 2021, meaning that if a clinician has eligible-APM-like arrangements for their other patients (privately insured, Medicare Advantage, Medicaid), these arrangements could count towards their APM share. We’ll discuss what an “eligible APM” means in a moment.

If clinicians do not participate in an eligible APM or do not have a sufficient amount of revenue (or patients) through an eligible APM, they are in the MIPS track. The MIPS consolidates three of the existing payment adjustment programs for clinicians: the physician quality reporting system (PQRS), the payment adjustment for the meaningful use of electronic medical records (eHR), and the value-based payment modifier (VM). Under the MIPS, clinicians will receive positive or negative adjustments to their FFS annual payments based on their performance in four areas: quality, resource use, clinical practice improvement, and meaningful use of eHR. The legislation allows CMS to retain the measurement process for PQRS, eHR and VM for use in the MIPS but merges the separate payment adjustments into the one MIPS adjustment.

What are the payment implications of these different paths?

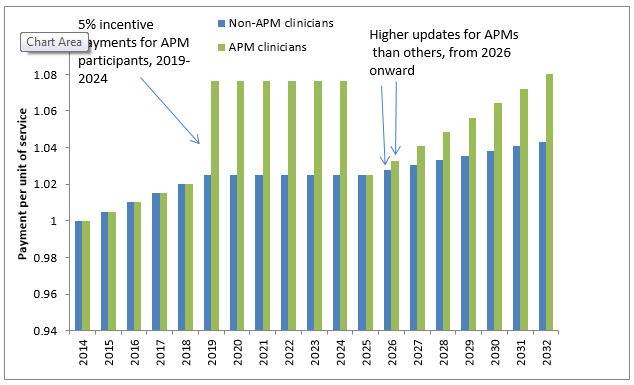

From 2016 through 2019, updates for all clinicians under the fee schedule will be 0.5 percent each year. Beginning in 2019, clinicians on the APM path will receive additional payments of five percent each year through 2024 that they meet the APM criteria. Qualifying APM participants will also receive a higher update than MIPS participants in 2026 and later; 0.75 percent versus 0.25 percent (Figure 1). Figure 1 also shows that Medicare payments to qualifying APM participants per unit of service will decline in 2025 relative to 2024, as the APM incentive payment does not compound. The objective appears to be to create an incentive from 2019 to 2024 for providers to move into APMs, and thereafter, to set the APM and MIPS providers on different update paths.

Figure 1. Illustrative update path for qualifying APM participants and for other clinicians

Note: 2014=1.0.

Clinicians on the MIPS path will receive no update from 2020 through 2025, and will receive a lower update in 2026 and beyond (0.25 percent). In addition, beginning in 2019, they will be subject to the MIPS performance adjustment factor, which will increase or decrease their payments depending on how well they perform. There is a maximum reduction for clinicians in the bottom tier of performance: 4 percent in 2019, 5 percent in 2020, 7 percent in 2021, and 9 percent in 2022 and subsequent years. In aggregate, the annual MIPS adjustment must be budget neutral, meaning that the reductions for lower performing clinicians must be balanced by the increases to higher performing clinicians. However, to achieve budget neutrality, adjustments may need to be scaled so that the maximum positive adjustment for high performers is larger than the maximum negative adjustment for poor performers that is specified in statute.

What is an eligible APM?

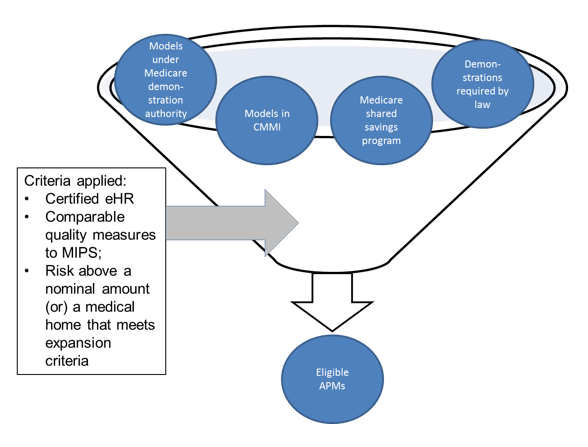

The process of determining “eligible” APMs begins with defining the pool of allAPMs. According to MACRA, the pool of all APMs includes all models in the Center for Medicare and Medicaid Innovation (CMMI) (except for Innovation Awards), the Medicare Health Care Quality Demonstration (established by the Medicare Modernization Act), the Medicare Shared Savings Program, or a demonstration required by law.

Presently CMMI runs approximately 60 separate models in seven categories: accountable care, episode-based payment initiatives, primary care transformation, initiatives focused on Medicaid and CHIP, initiatives focused on dual eligibles, initiatives focused on accelerating new payment and delivery models, and initiatives to speed the adoption of best practices. In addition, the Medicare shared savings program (MSSP), which is part of permanent Medicare law, is also considered an APM.

Another mechanism for the development of APMs is through the Physician-Focused Payment Model Technical Advisory Panel established in MACRA. This panel is designed to provide comments and recommendations to the HHS Secretary. This panel could develop or approve models and submit them to the Secretary for her consideration. Any models coming through the Technical Advisory Panel would then need to be run through the CMMI process to be considered as part of the pool of APMs.

Of this group of all APMs, eligible APMs must meet three key criteria defined in MACRA. Eligible APMs must:

- Use a certified eHR;

- Have quality measures comparable to MIPS; and

- Must bear financial risk above a nominal amount, (or) be a medical home meeting the expansion criteria.

Note that although eligible APMs must engage in quality measurement and bear financial risk (except for certain medical homes), there is no statutory requirement that they actually perform well on quality or reduce costs in order for their clinicians to receive the 5 percent incentive payment.

Figure 2. Eligible APMs could be a small subset of all APMs

Note: Demonstration authority refers to the Medicare Health Care Quality Demonstration established by the Medicare Modernization Act

Note: Demonstration authority refers to the Medicare Health Care Quality Demonstration established by the Medicare Modernization Act

What kinds of implementation issues will CMS need to work through?

In order to begin administering the MIPS and APM programs in 2019, CMS will need to go through the rulemaking process and have regulations in place by 2018, which is the base year for the APM incentive payments as well as the MIPS payment adjustments starting in 2019. At the October meeting, the Commission highlighted several of the key implementation issues that CMS will have to address.

First, what spending is the APM responsible for? The spectrum would seem to range from spending only for the services the APM clinicians bill for at one end, to total Part A and Part B spending for a beneficiary for the year at the other end. It could also be something in between such as spending in a bundle for some period (for example all services around a hip replacement for 30 days post discharge).

Another issue CMS will have to determine is rules for attributing clinicians and beneficiaries – and hence their spending – to APMs. Third, CMS will have to decide what quality “comparable to MIPS” means. And finally, CMS will have to define risk above a nominal amount.

The Commission plans to continue discussing these issues over its forthcoming meeting cycle, with the goal of providing guidance to CMS throughout the implementation process.