Every year, the Commission makes recommendations about how Medicare’s payments to providers should change in the year to come. The process of developing these recommendations typically begins at MedPAC’s December meeting, when staff present analyses on each of the fee-for-service (FFS) sectors under consideration (nine in total), and Commissioners debate draft recommendations for how payment rates should be updated. The Commission also reviews the status of the Medicare Advantage and Part D prescription drug programs and makes recommendations as appropriate.

As a starting point for the FFS discussions, the analyses that are presented in December assess whether Medicare’s payments are adequate in the current year. The Commission has historically reviewed four factors when looking at payment adequacy: beneficiaries’ access to care (measures of access include supply of providers and service utilization), quality of care, providers’ access to capital, and providers’ Medicare margin (a measure of the relationship between Medicare’s payments and providers’ Medicare costs). This “payment adequacy framework” is applied consistently across all of the sectors (check out this post for more information on the update process).

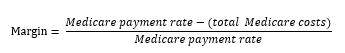

When looking at Medicare’s payments relative to providers’ costs, the Commission has historically compared Medicare’s total payments to providers’ total allowable Medicare costs using the following formula:

The resulting margin is an indication of whether Medicare’s payments are covering providers’ costs to care for Medicare patients. There will always be a wide variation in the distribution of margins across any provider group, and the goal is not to ensure that every provider has positive margins. Rather, the Commission is interested in whether, on average, Medicare’s payments are covering costs for a given type of provider.

This year, in addition to its traditional margin calculation, the Commission is considering a new aspect of the relationship between Medicare payments and providers’ costs: Medicare payments relative to providers’ marginal costs, i.e. marginal profit. Marginal costs are those costs that vary with volume, as opposed to the fixed costs that providers incur regardless of how many patients they serve. As with standard margins, the marginal profit calculation will be just one piece of information considered in the Commission’s broader payment adequacy framework.

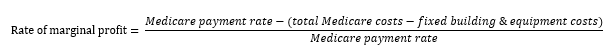

The marginal profit provides information about whether providers have a financial incentive to see Medicare patients. In considering whether to treat a patient, the provider compares the marginal revenue it will receive (i.e., the Medicare payment) with its marginal costs. In the near term, if Medicare payments are larger than the marginal costs of treating an additional beneficiary, and a provider has excess capacity, it has a financial incentive to see Medicare patients. In other words, in the near term a provider’s fixed costs remain the same whether it treats a patient or not, and Medicare’s payment covers the variable cost that it incurs for treating a Medicare patient. On the other hand, if marginal payments do not cover marginal costs, the provider may have a disincentive to admit Medicare beneficiaries, since it will be losing money with every patient it treats. To operationalize this concept, we compare the Medicare payment rate to marginal costs, which is approximated as:

Based on its evaluation of all components of the payment adequacy framework, including access, quality, and access to capital as well as providers’ payments and costs, the Commission will vote on final payment update recommendations at its January meeting.