MedPAC’s March 2016 report contains two recommendations for the Medicare Advantage (MA) program. This post will focus on the MA recommendation pertaining to health risk assessments (HRAs).

HRAs are a preventative care tool used to identify health risk and evaluate patients for the presence of disease or disability. HRAs focus on patient behaviors, medical history, and current physical health. The Commission supports the use of HRAs. When HRAs are administered in conjunction with appropriate feedback and with connection to available resources, they can be a powerful tool for achieving better care coordination and engaging the beneficiary in their own health management and decision making.

Under current policy, diagnoses generated from HRA documentation are used to determine Medicare payments. Medicare calculates its payments to plans separately for each beneficiary by multiplying the plan’s payment rate by the beneficiary’s risk score. Generally, the more diagnoses a beneficiary has, the higher their risk score and by extension Medicare’s payment to the plan. Thus, plans have a strong incentive to ensure that all diagnoses for each beneficiary are recorded completely. Analyses performed by MedPAC and others show that because of coding practices, beneficiaries in MA plans have higher risk scores than they would had they remained in FFS.

One possible source of coding differences between MA and FFS beneficiaries is the use of diagnoses documented on HRAs for risk adjustment. If a condition is documented on an HRA, current policy would increase payment to the MA organization, but there is no guarantee that the beneficiary would receive any treatment for the condition or other benefit resulting from HRA documentation. MedPAC analysis of MA 2012 encounter data showed that 37 percent of the time, conditions were documented on an HRA but had no additional documentation showing that follow up care was provided for the condition (known as HRA-only documentation).

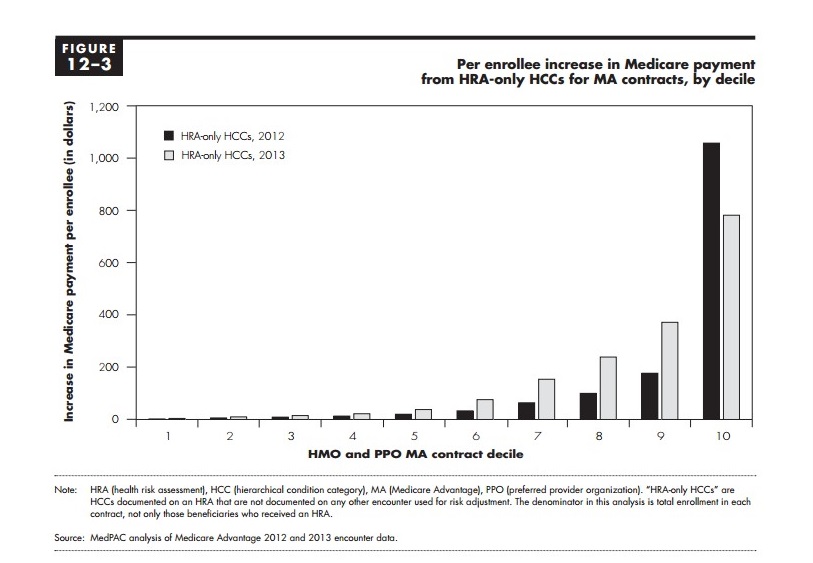

The number of HCCs identified through HRAs alone varies significantly across MA plans, as shown by our analysis of MA encounter data. For the MA contracts administering at least one HRA in 2012 or 2013, Figure 1 shows the average increase in annual Medicare payment per enrollees from HRA-only codes. The figure shows contract ranked into decile groups. Not all MA contacts received a significant source of revenue from HRA-only codes. Rather, a small proportion of contracts generated substantial Medicare payments from HRA-only codes, shown in the highest decile.

Figure 1: Per enrollee increase in Medicare payment from HRA-only HCCS from MA contracts, by decile

In our March 2016 report, we recommended excluding HRA-only diagnoses from the risk adjustment model. This would mean that a diagnosis would have to be associated with some treatment for the condition in order for an increase in a beneficiary’s risk score and Medicare payment to the MA organization. We also recommended that CMS use two years of diagnostic data for the model. Using two years of diagnostic data will allow providers greater ability to document enrollees’ chronic conditions, and provide an ample amount of time to follow up on HRA diagnoses.

We believe this policy would both minimize current risk adjustment differences between MA and FFS beneficiaries, promote greater fairness among plans, and improve the accuracy of the risk adjustment model, therefore improving the accuracy of Medicare payments to plans. Further, to the extent that diagnoses from HRAs are accurate and follow-up care is not provided for what may be a major chronic illness, the Commission is concerned that some plans may not be providing adequate care coordination and chronic disease management for enrollees. The recommendation would help alleviate this concern. Our recommendation places no restrictions on providing HRAs to Medicare beneficiaries in any setting, and all plans could continue to use HRAs for care planning and management. In fact, if such a policy were implemented, the Commissions would hope that the proper use of HRAs would increase among Medicare beneficiaries who may benefit.