The Commission recommends Advanced Practice Registered Nurses (APRNs) and Physician Assistants (PAs) bill Medicare directly, eliminating “incident to” billing for their services.

Medicare beneficiaries are increasingly reliant on advanced practice nurses (APRNs) and physician assistants (PAs) for their care.[1] APRNs and PAs are graduate-level trained clinicians who often work in collaboration with or under the supervision of physicians to deliver care to patients.

The number of nurse practitioners (NPs), one type of APRN, and PAs billing Medicare has grown rapidly. State governments have also expanded scope of practice laws, enabling NPs and PAs to practice with more authority and autonomy. Between 2010 and 2017, the number of NPs and PAs that billed Medicare more than doubled, reaching 212,000 in 2017.[2] And, while NPs and PAs have historically been concentrated in primary care, they are increasingly practicing in specialty fields.

Despite their growing role in the delivery of care, Medicare often does not know when NPs and PAs provide services to Medicare beneficiaries. Because of an artifact of Medicare law called “incident to” billing, Medicare lacks information on which providers are furnishing care to beneficiaries, and beneficiaries and the Medicare program are paying higher costs.

The Commission examined how Medicare pays for care delivered by NPs and PAs. In January 2019, the Commission made two recommendations to update Medicare’s payment policies to better reflect current clinical practice, improve Medicare’s oversight of providers, and produce savings for Medicare and its beneficiaries.

Commission recommendations

To improve Medicare’s payment policies for APRNs and PAs, the Commission recommended:

1. The Congress require APRNs and PAs to bill the Medicare program directly, eliminating “incident to” billing for services they provide; and

2. The Secretary refine Medicare’s specialty designations for APRNs and PAs.

The Commission examined how Medicare pays for care delivered by NPs and PAs

NPs and PAs can bill directly for the services they provide to beneficiaries under their own national provider identifiers (NPIs). However, these services (provided by NPs and PAs) can also be billed by a supervising physician when certain conditions are met[3]. This practice is known as “incident to” billing.

Medicare pays 85 percent of the physician fee schedule (PFS) rate when a service is billed under the NP’s or PA’s own NPI, but Medicare pays 100 percent of the PFS rate when the same service provided by an NP or PA is billed “incident to” a supervising physician. A bill for a service that is provided “incident to” a supervising physician is indistinguishable from a bill for a service provided directly by the physician: The physician’s NPI is entered on the claim, and there is no indication whether the service was provided by an NP or PA and billed “incident to” or provided directly by the physician. Thus, when a service is billed “incident to,” Medicare cannot know who actually delivered care to the beneficiary.

Medicare’s “incident to” billing creates several problems. It:

- Undermines the accurate valuation of physician services;

- Constrains policymakers’ ability to evaluate the cost and quality of care delivered by NPs and PAs; and

- Unduly increases costs for Medicare beneficiaries and the Medicare program.

Medicare’s “incident to” policy can be traced back to a time when NPs and PAs could not bill Medicare directly. Medicare’s billing rules have since changed to allow NPs and PAs to be paid directly for their services. But, the practice of “incident to” billing continues to exist as an artifact of Medicare’s past, permitting a substantial share of services furnished by NPs and PAs to Medicare beneficiaries to be billed “incident to.”

Commission analyses of “incident to” billing

Medicare only permits “incident to” billing for certain patients in non-institutional settings. For example, physician office services provided by NPs and PAs to established patients can be billed directly by the NP or PA or can be billed as “incident to” by the supervising physician. But, services provided by NPs and PAs to new patients in physician offices cannot be billed as “incident to” by a supervising physician; rather, they must be billed directly by the NP or PA, using their own NPI. Medicare prohibits “incident to” billing for any services performed in institutional settings. For example, in hospital outpatient departments (HOPDs), all services NPs and PAs provide, whether to new or established patients, must be billed directly by the NP or PA. Importantly, these billing rules affect only the ways in which services can be billed—not the services NPs and PAs can provide.

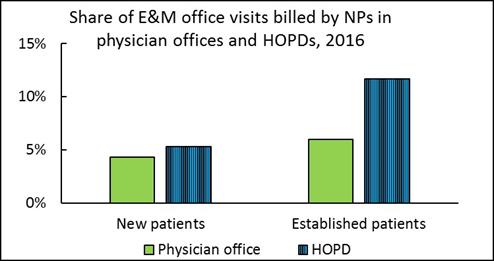

By examining differences in billing patterns, we estimated the share of evaluation and management (E&M) visits provided by NPs in physician offices to established patients that were likely billed “incident-to” under a supervising physician’s NPI.

For new patients (where the billing data should accurately reflect who provided care because “incident to” billing is always prohibited), NPs billed a similar share of E&M services in the physician office and the HOPD (the green and blue bars on the left side of the figure). But for established patients (the green and blue bars on the right side of the figure), NPs billed a much higher share of services in the HOPD (where the billing data should more accurately reflect who provided care because “incident to” billing is prohibited) than in physician offices, where “incident to” billing is allowed for established patients. The relative difference in the share of office visits billed by NPs for established patients is likely explained by the prevalence of “incident to” billing.

We estimate that over 40 percent of all NPs’ E&M office visits for established patients performed in physician offices were likely billed “incident to” in 2016—and therefore appear in the claims data as though they were performed by a physician. (We conducted the same analyses for PAs and estimate that about 30 percent of their E&M office visits for established patients performed in physician offices were likely billed “incident to” in 2016; data not shown.)

Eliminating “incident to” billing would not change the way care is delivered

Eliminating “incident to” billing for APRN and PA services and requiring these clinicians to bill directly under their own NPIs would change Medicare’s billing policies so that claims accurately reflect who is providing services to beneficiaries. Eliminating “incident to” billing would not change state supervision or collaboration requirements, nor would it require changing the way care is delivered. The policy change would only directly alter the bill that the provider submits to Medicare for payment.

Requiring direct billing and eliminating “incident to” billing for NP and PA services could enable Medicare to set payment rates for PFS services more accurately and allow policymakers to evaluate the cost and quality of care delivered by NPs and PAs. In addition, because Medicare pays for services at 85 percent of the PFS rate for care billed by NPs and PAs, eliminating “incident to” billing would produce program savings and reduce beneficiary cost-sharing.

Medicare’s specialty designations for APRNs and PAs

To better identify the types of services provided by APRNs and PAs, Medicare should also collect information about the specialties in which APRNs and PAs practice.

Medicare often relies on specialty information to target payments (e.g., targeting payments to primary care); construct alternative payment models (e.g., attributing beneficiaries to accountable care organizations); and assess beneficiary access, resource use, and quality of care. Although it is often assumed that NPs and PAs practice primary care, some evidence suggests that many NPs and PAs provide specialty care. But, Medicare has limited data on the specialties in which APRNs and PAs practice. When providers enroll to bill the Medicare program, they are required to specify a specialty designation. However, NPs and PAs can only select “nurse practitioner” or “physician assistant” as their specialty designation; no information regarding the specialty in which NPs and PAs practice is reported.

Given the growing role of APRNs and PAs in the delivery of specialty care, improving the specialty information available to Medicare is important to the efficacy and integrity of Medicare’s programs.

The Commission’s analyses and recommendations will be included in its June 2019 Report to the Congress.

[1] The APRN category includes nurse practitioners (NPs), clinical nurse specialists (CNSs), certified registered nurse anesthetists (CRNAs), and certified nurse midwives (CNMs). NPs are the largest subgroup of APRNs billing Medicare.

[2] MedPAC analysis of 100 percent Carrier standard analytic files.

[3] For example, services must be rendered under the direct supervision of a physician, meaning the physician must be present in the office suite and immediately available. (It does not mean that the physician must be present in the room when the service is furnished.)