In the March Report to Congress, we discussed the status of the Medicare Part D program. In 2015, Medicare spent $80 billion under Part D, and enrollees paid an additional $11.5 billion in premiums and $15 billion in cost sharing. Some of Medicare’s payments to plans came in the form of monthly prospective amounts for each enrollee (adjusted for risk), and also as open-ended retrospective payments for enrollees with high drug spending, called individual reinsurance.[1] When combined, those Medicare payments are supposed to pay for 74.5 percent of the cost of basic benefits, and enrollees pay the remainder in premiums.

From 2010 to 2017, Medicare spending on the monthly prospective payments grew rather slowly, and average premiums for Medicare Part D enrollees remained between $30 and $31 per month. However, Medicare spending on reinsurance payments for enrollees with high drug costs grew on average more than 20% per year since 2010. In this blog post, we discuss several factors that have contributed to that high growth in recent years.

Part D has a unique benefit structure. A Part D plan’s liability varies as an enrollee’s drug spending increases during the course of a year. After an enrollee reaches the OOP threshold (at about $8,100 in gross drug spending in 2017), the plan is only responsible for covering 15% of any additional spending. Medicare covers 80% of the remaining spending by making reinsurance payments, and the beneficiary is responsible for 5%. This benefit design can create incentives for a plan to include certain high-cost drugs on their formulary over others, which can increase Medicare spending for reinsurance. We discuss these incentives more later in this post, and additional information about the design of the Part D benefit also can be found here.

CMS has pointed to another factor that has both moderated Part D premiums while increasing Medicare’s reinsurance payments—expanding amounts of “direct and indirect remuneration (DIR),” the agency’s term for manufacturers’ rebates, pharmacy fees, and other price concessions that lower costs after the point of sale. In 2014, DIR totaled $17.4 billion, of which manufacturer rebates made up $16.3 billion. According to the Medicare trustees, DIR grew from 8.6 percent of gross Part D drug spending in 2006 to 17.2 percent in 2015. As CMS notes, larger shares of DIR mean greater differences between gross prices at the point of sale and the net financial obligation of plan sponsors. Rising prices have contributed to the expansion of DIR, which has in turn contributed to both slow growth in premiums and fast growth in reinsurance payments. Premiums and fixed-dollar copayments are lower for all enrollees when plan sponsors offset their benefit costs with DIR. However, enrollees who instead pay coinsurance for their prescriptions do not see any reduction to their cost sharing because coinsurance is based on the price before any DIR is applied. The OOP threshold is based on the higher (gross) price. This contributes to more beneficiaries exceeding that OOP threshold and increases Medicare’s payments for reinsurance. Increased DIR has mixed effects on beneficiaries. On the one hand, beneficiaries experience lower premiums, but on the other hand, they tend to incur higher cost sharing.

MedPAC Commissioners were briefed earlier this year on factors that are pushing Part D toward higher spending for catastrophic benefits, and we highlight three here. First, prices for brand-name drugs have grown aggressively (reflecting increases by manufacturers and the move toward new drugs with high launch prices), overwhelming the moderating influence of generics. Second, Part D requires manufacturers to provide a 50 percent discount on brand-name drugs for enrollees in the coverage gap. Under law, the discount is added to the enrollee’s OOP spending, so beneficiaries reach the OOP threshold faster. Third, retiring baby boomers are expanding the number of enrollees.

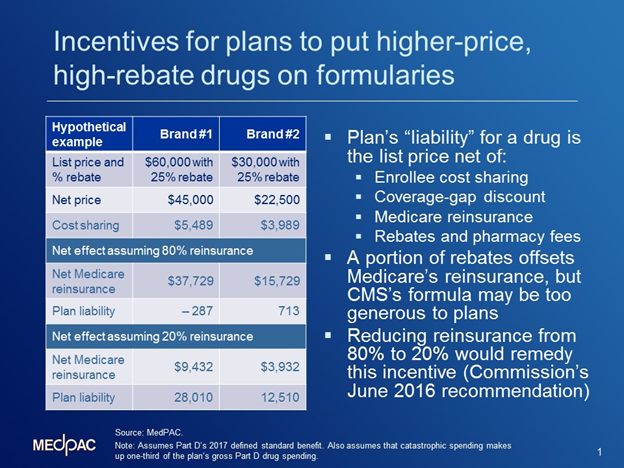

A final factor behind the push toward more catastrophic benefits in Part D may be an unintended consequence of Part D’s benefit structure that may provide financial incentives for plan sponsors to put some higher priced drugs on their formularies. The slide below comes from MedPAC’s January meeting and presents an example of those incentives.[2] In some cases, sponsors’ decisions to place certain higher-price drugs on their formularies are a response to the financial incentives they face.

From 2010 to 2017, Medicare spending on the monthly prospective payments grew rather slowly, and average premiums for Medicare Part D enrollees remained between $30 and $31 per month. However, Medicare spending on reinsurance payments for enrollees with high drug costs grew on average more than 20% per year since 2010. In this blog post, we discuss several factors that have contributed to that high growth in recent years.

The slide shows a comparison for a sponsor deciding whether to include a drug with a list price of $60,000 and a 25 percent rebate on its formulary (shown in the column titled “Brand #1) or a $30,000 drug that also offers a 25 percent rebate (shown in the column titled “Brand #2). The middle panel illustrates the financial implications of the two drugs today under the current program design. Because today plan sponsors are responsible for paying only 15% of spending after an enrollee exceeds the OOP threshold, it can be financially beneficial to the plan to include a higher-priced drug on its formulary. In the example on the slide, the rebate and reinsurance amounts are so large that the sponsor could actually reduce its plan liability (and help lower its premiums or increase profits) by placing the more expensive drug (Brand #1) on its formulary. The middle panel illustrates that the plan can actually reduce its net liability by $287 by selecting Brand #1, the more expensive drug. By comparison, the plan would face a net cost of $713 for the lower priced medicine. Under that scenario, reinsurance payments by the Medicare program would be higher ($37,729 compared to $15,729). Cost sharing paid by the beneficiary would also be higher ($5,489 vs. $3.989).

In June 2016, the Commission recommended changes to Part D that would reduce Medicare’s reinsurance from 80 percent to 20 percent, among other changes. Those recommendations would ameliorate the financial incentives shown in the middle panel of the slide. If Medicare’s reinsurance was reduced to 20 percent, the sponsor would face much higher costs if it placed the more expensive brand on its formulary. The bottom panel illustrates how the plan’s financial incentives change under the recommendation. Now, the plan faces net costs of $28,010 for selecting Brand #1, compared with net costs of $12,510 for selecting Brand #2. By selecting the lower-priced medicine, beneficiaries who use that drug would also experience lower cost sharing ($3,989 rather than $5,489, and shown in the top panel because beneficiary’s cost sharing is based on the drug price). Medicare would also make lower reinsurance payments when the plan chose the lower priced medicine ($12,510 compared with $28,010).

Overall, MedPAC expects that this recommendation would reduce Medicare spending under Part D, by providing plans with better financial incentives to include lower-priced drugs in their formularies. Beneficiaries would also benefit from lower cost sharing if they selected those lower-priced drugs.“Lastly, because Medicare’s overall subsidy would be the same, plans would receive higher monthly fixed-dollar payments when they assume responsibility for more spending in the catastrophic portion of the benefit. [3]

[1] Medicare’s remaining spending under Part D was for the retiree drug subsidy and the low-income subsidy.

[2] Other research organizations have made similar observations about these incentives to include higher-priced drugs on formularies, such as a study conducted by Milliman.

[3] To keep Medicare’s overall subsidy at 74.5 percent, and alleviate premium increases, Medicare would increase plans’ monthly capitated payments. CMS would also need to recalibrate its Part D risk adjustment system for the capitated payments