At MedPAC’s public meeting last week, the Commission discussed how Medicare shares financial risk with Part D prescription drug plans. When Part D was first conceived, policymakers were concerned about whether insurers would be willing to participate in a program offering stand-alone drug plans to Medicare beneficiaries. As a result, several safeguards were put in place to limit plan’s financial risk in the program. Today, with nearly a decade of experience with Part D and a robust set of plan offerings, the Commission is exploring whether Part D’s risk sharing mechanisms are still structured in a way that makes sense.

This post is your explainer for the various risk sharing mechanisms in Part D.

Direct Subsidy & Risk Adjustment

The basic building block of Part D payment is the DIRECT SUBSIDY. Medicare pays a fixed-dollar amount to plans each month for each enrollee. This capitated amount is risk adjusted by factors that take enrollees’ health and expected spending into account, so plans are paid relatively more for sicker enrollees and relatively less for healthier ones. These concepts should be familiar, because they’re used in payment systems for Medicare Advantage health plans and in prospective payments to hospitals.

Individual Reinsurance

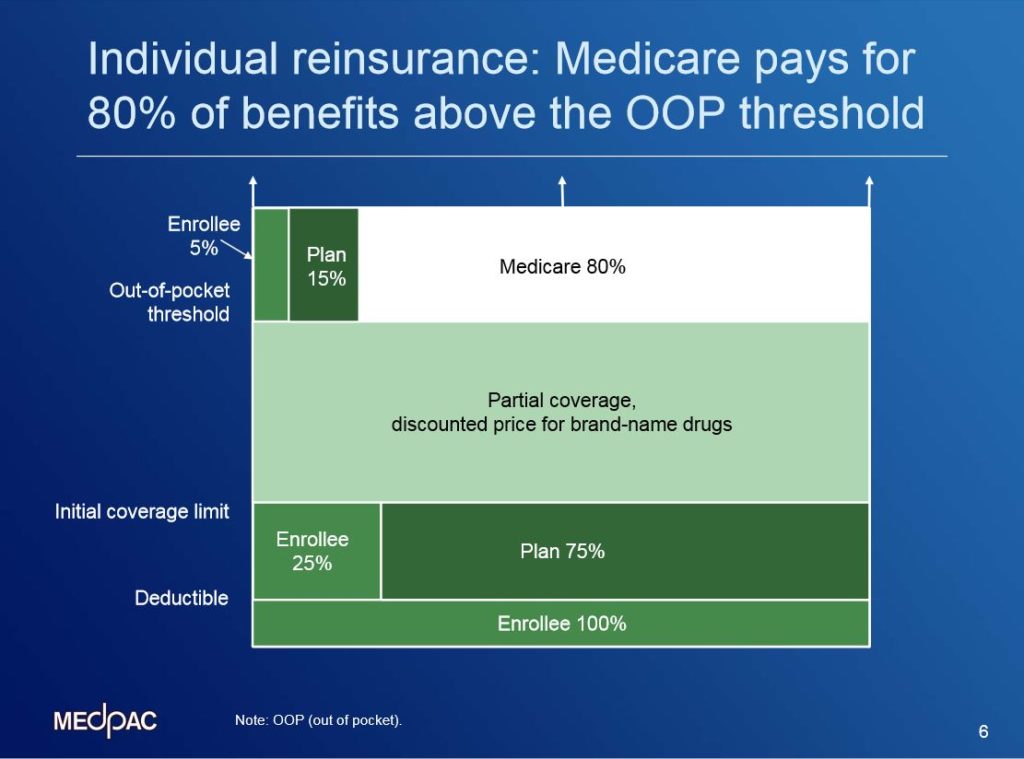

The amount of financial risk that Part D plans bear for the enrollees with high prescription drug spending is somewhat mitigated by a component of the payment called INDIVIDUAL REINSURANCE. When an enrollee has spending that is sufficient to reach the out-of-pocket threshold (also known as the catastrophic cap, set at about $7,000 in 2015), Medicare is responsible for the majority of the additional spending over this limit. In this diagram showing the Part D standard benefit, notice at the top of the figure in white that Medicare pays 80% of benefit spending above the OOP threshold, while the plan pays 15% and the enrollee pays 5%. In 2012, about 2 million Part D enrollees had gross drug spending high enough to reach the point where Medicare pays for individual reinsurance. More than 70% of those 2 million individuals receive Part D’s low-income subsidy. This is higher than the proportion of LIS enrollees in the general Part D population – only about a third of Part D’s enrollees receive the LIS.

Individual reinsurance is the fastest growing component of Part D payments. It’s grown from $8 billion in 2007 (or 19% of program spending) to nearly $20 billion in 2013 (31% of program spending). That’s cumulative growth of 143%.

Risk corridors

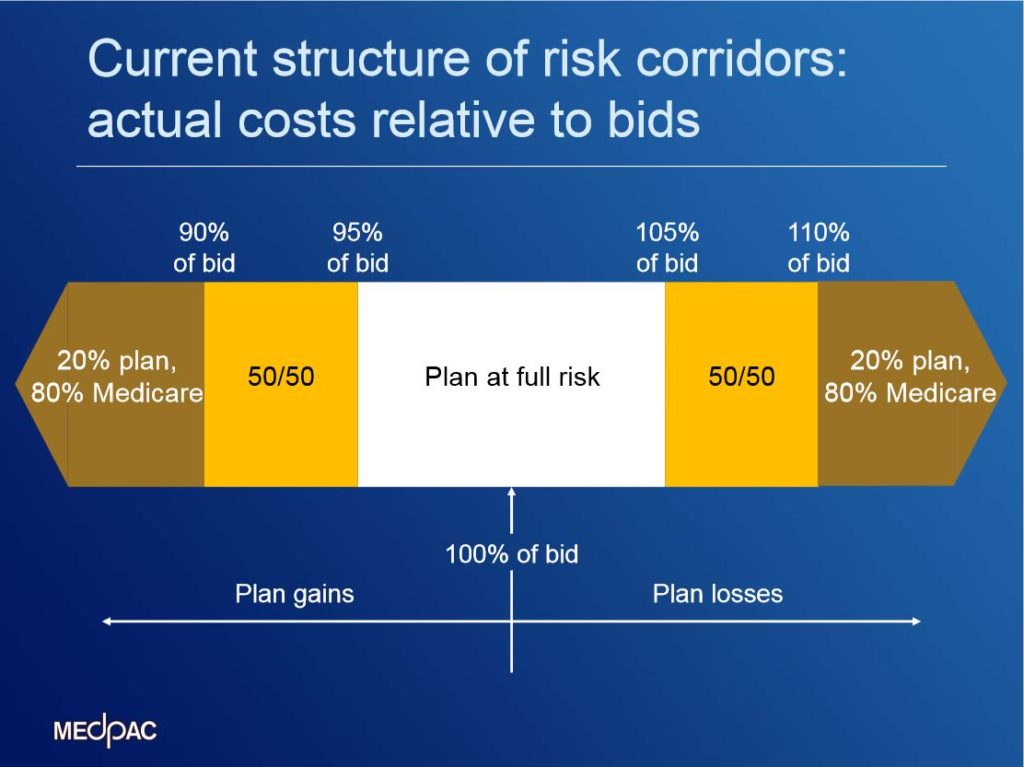

While the reinsurance is designed to protect plans against high costs of individual enrollees, Part D also shares risk with plans at the aggregate level. Part D uses symmetric RISK CORRIDORS that were designed to share aggregate losses and gains that are larger than expected. This figure shows the current structure of the corridors. After a benefit year is over, CMS compares the plan’s average cost for benefits paid with what the plan sponsor bid. The sponsor has to pay for all benefit spending that is up to 5% higher than what they bid. They also get to keep any profits when spending is up to 5% lower than their bid. If the plan paid out even more (or less) in claims, Medicare shares those losses or gains with the plan sponsor. There’s a range where they split things 50/50, and then Medicare pays for 80% for larger losses—or gets 80% of the gains.

In every year since Part D began, plan sponsors have—in the aggregate—paid back money to Medicare—meaning their average spending for the direct subsidy was lower than what they bid. In each year, about three-quarters of sponsors had to make payments back to Medicare. The aggregate amount they paid has been on the order of $900 million to $1 billion each year for benefit years 2010 through 2012 (for context, total Part D spending was about $90 billion in 2012). So if the corridors were eliminated and plan sponsors continued to bid too high, they would keep those payments instead of giving them back to Medicare.

_________________________

The Commission will return to the topic of risk sharing mechanisms again during the 2014-‘15 meeting cycle, and may consider options for better tailoring these mechanisms to current policy goals.

For more information about Part D, check out the Commission’s annual Part D status report. It includes information about beneficiaries’ experiences with Part D, as well as about changes in plan bids, premiums, benefit designs, and formularies.